Migrant workers with bank accounts both in their host country and back home can transfer funds electronically between their accounts. However, without an overseas bank account, or access to their national bank account their remittance options are limited to a branded cash transfer company (charges up to 12%) or to an illegal money transfer business.

Many banks do have a presence overseas, but they may not have a branch network. We know that this can make funds transfer difficult for bank customers.

The PiP iT banking solution facilitates cross-border CASH lodgement to an international bank account.

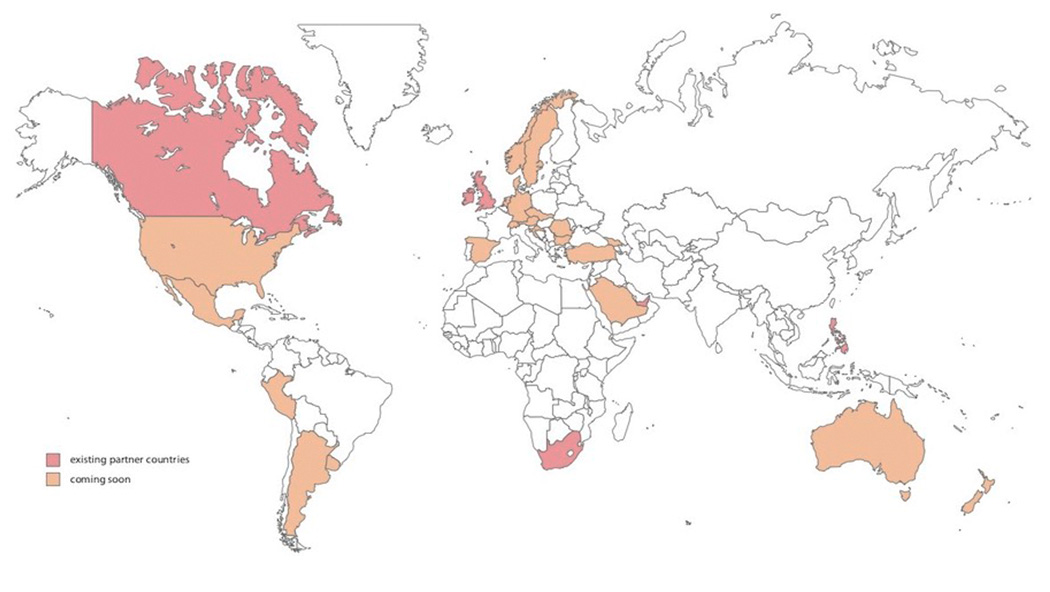

The growing PiP iT Collection Network operates as an International Branch Network for our client banks:

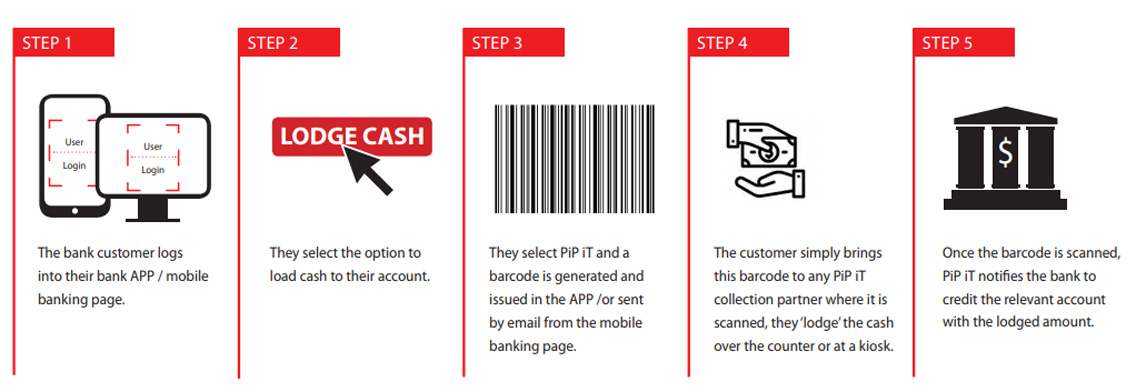

How does it work?

PiP iT banking allows customers to lodge cash into their bank accounts from anywhere. It couldn’t be simpler to use.

Why is PiP iT banking good for your bank?

Cash is universal and ensuring its continued use is the first step towards financial inclusion. Cash-friendly initiatives successfully boost inclusion by building upon this fact as communities trust and know cash very well.

PiP iT banking offers a unique opportunity to democratise banking in developing economies by bringing large numbers of its unbanked population into their system, and helping customers to leverage their bank accounts in a cost-effective, meaningful, reliable and secure way.

The PiP iT banking solution fulfils the financial interests of a bank while ensuring a continued ownership of the relationship with their customers, in the following ways:

- – Capturing additional revenue by building and retaining deposits, which will lead to further upselling opportunities

- – By establishing a presence in the large unbanked customer segment

- – By leveraging an innovative paytech solution that reduces the cost of providing banking services to the unbanked

- – Earning income from fees for handling an end-to-end payment process

The PiP iT banking solution gives your customers what they want – low transaction costs, worldwide access and convenience through a service that is relevant to their needs.

PiP iT understands the challenges associated with bank customer management

| Limited geographical reach – particularly internationally | High cost of overseas infrastructure and partner network | Lack of customer-level information on account of transactions through different channels and bank network |

| High cost of acquisition – offering a meaningful service to poorer customers | Understanding how customers are using their accounts | Absence of in-house mechanisms to promote customer loyalty and upselling |

| High cost of infrastructure and overseas access | Competitive fees structure | Impedes the ability to build the brand |

THE PIP IT BANKING SOLUTION WILL HELP TO |

||

|

Grow your customer base – encourage migrant workers to open a bank account before they leave your country and send cash home securely through the PiP iT Collection Network. Reconnect with your dormant account holders who have emigrated. Encourage them to send cash to their account from abroad using PiP iT banking and reduce the cost of sending money home. |

Dramatically reduce the cost to your customers of sending money back home, so a larger proportion of each transaction ends up in your bank. Upgrade your financial inclusion strategy. By encouraging customers to make a bank lodgement instead of a cash remittance, the consumer is building up a track record and credit history. Keep in touch with your overseas customers and encourage financial responsibility through regular lodgements and savings. |

Re-engage your customers. Once a bank account is activated, through the regular use of PiP iT banking, customers are empowered with a saving and spending pattern and most importantly a credit history – making them potential borrowers.Savings and loans services will add strength to your financial inclusion strategy. Aid financial inclusion by promoting this service as a way to keep customers and their families safer by not having to queue at collection points and carry cash on the street. |